Regardless of where you store receipts, consider tabulating the data periodically throughout the year.

HOW TO ORGANIZE YOUR BILLS AND RECEIPTS HOW TO

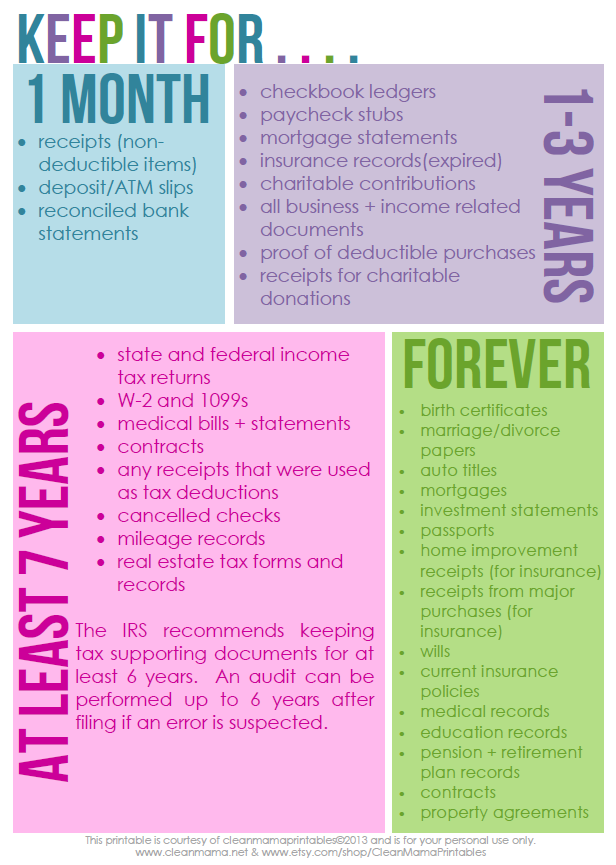

How to Organize Receipts Tip 8: A Little Legwork Now Goes a Long Way Later Simply tape in one receipt per page and jot down relevant information (why it’s a business expense, payment source, etc.) alongside. It’s uncluttered and captures relevant details along the way. (Not recommended if you accumulate more than one receipt per week.) The best method is a small notebook. It’s just what it sounds like – toss your receipts in a box. If you don’t trust yourself to do any work, go with the box method. Dealing with a year’s worth of jumbled receipts is even less fun than it sounds – separate receipts by month or category to help you make sense of them down the road. If you go with file folders, subdivide and conquer. This is the unsexy essence of receipt management. However, if you don’t file taxes on a given year, you’ll need to keep those receipts indefinitely – the IRS statutes of limitation only apply if you file.īest practices for storing and managing physical receipts How to Organize Receipts Tip 7: Where to Keep Them? In most cases, you can get rid of receipts three years after the corresponding filing year. How to Organize Receipts Tip 6: Three-Year Statute of Limitations But while digital receipt management is preferable to many of us, it is only accepted by the IRS when it complies with the labyrinthine legalese of Revenue Proclamation 97-22, which requires an indexing system to prevent alteration or deletion of information. When claiming client dinners as business expenses, you’ll need to provide the particulars – what’s the business purpose of the dinner? Who was there, and which organizations did they represent? The easiest way to handle this: write it down on the receipt! How to Organize Receipts Tip 5: Keep Physical Copies How to Organize Receipts Tip 4: Don’t Assume You’ll Remember the Details You can do this by simply matching physical (or digital) receipts to your bank statements, but it’ll help you big time if you keep a log of expense details (who attended the business dinner, etc.) along the way.

If you get audited, you’ll need to prove both that each deducted expense occurred and that you paid for it (and how). The basic requirements of receipt documentation How to Organize Receipts Tip 3: The Burden of Proof is On You

Now that you’re only keeping what you need, make sure everything is recorded legitimately. Plus, you’ll still need evidence to establish who paid for them and how. Unfortunately, this only applies to entertainment, overnight travel, and listed property expenses. According to Publication 463, receipts for deductible expenses under $75 aren’t necessary. If you’ve heard about this convenient loophole, your best move is to purge it from your mind. How to Organize Receipts Tip 2: Ignore the $75 Rule Here’s a list of popular deductions to consider. Not all receipts are tax-deductible, and if you avoid the work of separating the deductible receipts up front, you’re only creating clutter that makes it harder to work with your receipts come tax time. Start by knowing which receipts are worth saving How to Organize Receipts Tip 1: Don’t File Your Recycling But every penny your deductible expenses climb above those marks is money you’re walking away from. If your deductible expenses for the year fall below those sums, don’t bother with receipts.

The majority of households – 68.5% of returns in 2013 – opt for the standard deductions of $6,300 for individuals and $12,600 for married couples filing jointly.

Receipts are always troublesome to manage (taxing, if you will), so here’s a quick review of the basics, and some low- and high-tech recommendations, to help you organize receipts like a pro.īefore we get started, keep in mind that you only need to keep receipts if you’re going to itemize deductions. Whenever the new year comes around, a little alarm bell goes off in the back of our heads: taxes are coming! The best part of taxes is making deductions, so it’s time to break out those receipts.

0 kommentar(er)

0 kommentar(er)